For numerous Forex investors, EAs represent dozens of hours invested meticulously crafting an automated version of their very own trading strategy.

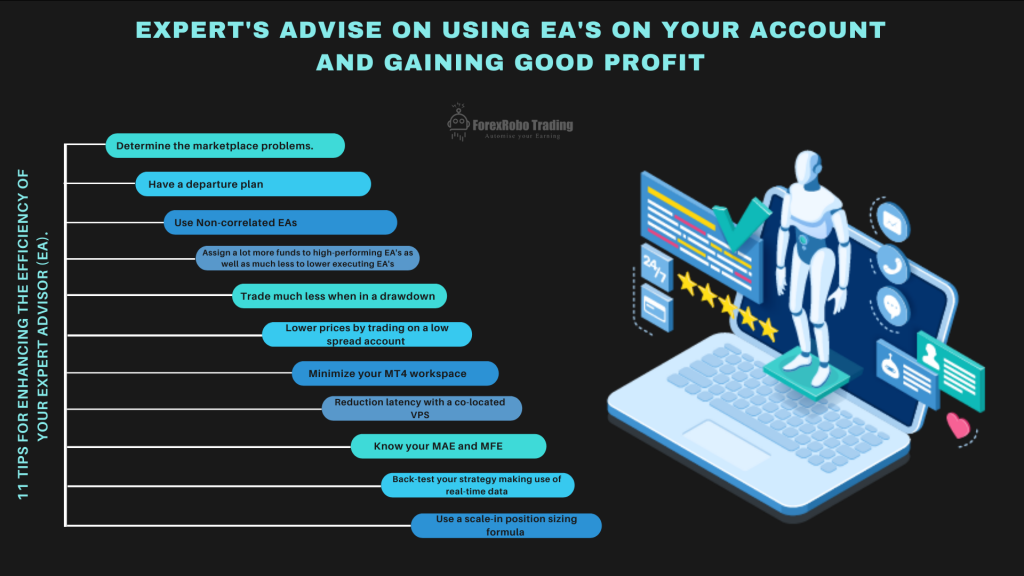

01. Determine the marketplace problems.

Determine the marketplace problems.

The primary factor that EA’s stop working to last the distance is because they don’t adjust to altering market conditions.

Developing an EA to operate in all problems is, otherwise a fool’s game, after that near it. It’s much easier to develop an EA that works well in some conditions and then change it on when those problems are in play.

Market trending? Run your EA that is designed for trending markets. Conditions come to be rough? Run your variety trading EA.

In the forex markets, both varieties and also patterns tend to exist for longer than you might believe, so utilize your discretion to make the most of that.

02. Have a departure plan.

Have a departure plan.

Do you understand what to do when your variety trading EA obtains captured in an outbreak, or your momentum EA is the target of a brief press?

Having a departure plan when market conditions alter is just as important as determining the market problems in the first place.

And also doubling up and expecting the most effective is not a good leave plan!

Pre-plan what you will certainly carry out in a negative circumstance. Should you cut your losses totally, or lower your trade size? Possibly you might hedge making use of an option, or location a hand-operated trade to counter the risk.

03. Use Non-correlated EAs.

Run numerous non-correlated EAs across various currency pairs, timeframes as well as methods.

Got an EA that works on the short-term? Currently construct one that deals with everyday charts.

Obtained an EA that works on majors? Exactly how about making an EA that deals with unique money sets.

Got an EA that is Algorithmic? Why not include an optional copy-trading strategy to your profile?

The more you can expand your basket of EAs, the much more robust your trading could come to be. Ideally, you intend to remain in a scenario where one EA offsets the performance of one more so you have a steadily growing equity contour.

04.Assign a lot more funds to high-performing EA’s as well as much less to lower executing EA’s.

Possibly one of the most crucial concern you need to ask on your own as a system trader is “how much?”.

How much financing you allocate to a system is mosting likely to figure out whether you reach your goals. If you have a terrific system and also allot the incorrect quantity of financing, it will do you no good, regardless of how much of a side the entrance and also exit guidelines have.

This mistake is very usual.

Not every system needs to have the very same allotment of funds. A better system can take a larger chunk of your funding, as well as a lower top quality system (that deserves trading) is offered less.

This is the optional aspect of system trading that can have a significant influence on your returns. As a manager of systems, you need to be proactive in taking control of your performance, and also not just leave it up to your code.

05. Trade much less when in a drawdown.

The 5th method to improve your system is to reduce the dimension of your professions when your EA is experiencing a drawdown.

Sitting on your hands when your EA is shedding is a recipe for disaster. Get to know your EA and what to expect from it, and also when it starts to undergo a losing duration then reduce your dimension.

Sure, you might miss out on some revenues every so often if your EA recovers quicker than expected, yet you can chalk that up as simply an expense of having a reliable risk management strategy.

06. Lower prices by trading on a low spread account.

Among the easiest means to boost performance is to minimize your costs. High spreads are hazardous in two means. One noticeable and also the various other not quite so.

They decrease your revenues. Every additional portion of a pip you pay appears of your system’s pocket.

You have a lot more losing trades. The broader your spread, the much more you obtain quit out. Easy as that. So while you might be paying a fraction of a pip much more, it might mean you shed several pips extra if a profession is stopped out.

This is likewise why you might locate a reduced spread with a commission option much better fit to EA trading. If the cost is not consisted of in the spread, after that the spread will be lower definition you get stopped out less.

07. Minimize your MT4 workspace.

Execution is important, as at the end of the day it can indicate the distinction in between a profitable and also a shedding trade. When it concerns the fastest market motions, nanoseconds can make a big difference to the cost you get.

One unknown method to Improve implementation is to minimize the number of windows you have open in your MT4 workspace. Specifically, close the market watch home window as well as any kind of charts you are not using, as these often tend to be rather data intensive attributes of the system.

Over unpredictable periods within the FX market, the volume of cost ticks rises– causing a rise in the amount of data that MT4 is required to upgrade. This can decrease the processing speed of your terminal, and also consequently the time taken for your EA to course orders in to the marketplace. Making the adjustments above minimizes the system to basics as well as improves the performance of the system.

08. Reduction latency with a co-located VPS.

Visualize if your EA was working on the computer system resting ideal next to your broker’s, cutting out any kind of delay in order execution.

With a co-located online personal server (VPS), this is exactly what you get. Your EA is installed on a computer system at the broker’s information centre, which you can access online.

Not only does this cut out hold-ups, but it likewise offers a significant perk in integrity as well as redundancy contrasted to running your EA by yourself computer.

09. Know your MAE and MFE.

Knowing your Maximum Adverse Excursion (MAE) as well as Maximum Forward Excursion (MFE) provides you a substantial side when it involves enhancing the efficiency of your system.

Your MAE will inform you just how much the professions your system positions generally enter into adverse area prior to they recover right into earnings. This is a big help in optimising stop-loss placement, which can improve the risk/reward proportion of your system’s professions.

Similarly, the MFE will inform you just how far your professions generally enter into profit before turning around. This permits you to enhance the earnings taking element of your trading strategy.

10.Back-test your strategy making use of real-time data.

Too often trading systems that look great theoretically fail to make the cut when they go online.

In some cases this is because of poor system style, but usually it is because the prices data that the strategy was back-tested on was poor.

Make certain you evaluate the strategy on the very same data that you are mosting likely to trade it with. Certainly the very same concern takes place when you run your EA on a trial account.

11. Use a scale-in position sizing formula.

Rather than concentrating on enhancing your entrance rules, divert your attention to the more profitable area of placement sizing.

In particular, check your strategy by running a scale-in design that contributes to winning trades as they choose you. In his book The Definitive Guide to Position Sizing, Market Wizard Van K. Tharp found that this was one of one of the most efficient methods to improve the efficiency of a strategy.

Try adding some scale-in policies to your EA, as well as you could be stunned just how much of an effect it has.

Over to you …

Now it’s your turn.

Using some or every one of the techniques laid out over can make the process of system trading a whole lot less difficult, and a lot more fun.

For Free Robo/EA Related Updates join Telegram Channel

https://t.me/fxrobo1

website:- https://forexrobo.trading

Whatsapp:-https://wa.me/971582630195

Telegram:-https://t.me/chat019

Email:- forexrobotrading1@gmail.com

Skype :- https://join.skype.com/invite/Y3BwHZ03sHFs