Technical analysis, a popular tool amongst forex traders, is based on an assumption that all relevant details about a trading instrument is shown in the market price. All you need to do is evaluate historical market data like cost or volume and spot patterns that might repeat in the future. Over time, technical experts have actually developed many indicators to help them fix this issue.

The math behind a sign doesn’t have to be very complicated. It can be an easy moving typical or a difference in between the closing price for 2 durations, however it can also be more complicated as standard deviation or direct regression.

Forex Indicators: Overview

It’s difficult to choose an indicator for a trading method. Some traders explore only one indicator, while others try to utilize a combination of indicators If you wish to utilize only one indicator, you’ll be concentrated on what amount of time to use and what duration you want to analyze. To calculate a sign, you initially need to select the time frame. You can apply it to everyday information, weekly information, per hour data and even higher frequency information. If you choose the day-to-day data, you can compute a moving average for the last 200, 100, 50 days and so on. Your strategy could be based upon a number of moving averages or you can attempt to use only one on your time series.

A mix of indicators is more intricate. Besides picking the time frame and the duration, you need to pick indicators that match each other. It’s generally recommended not to use two indicators from the same group of indicators due to the fact that they’ll simply confirm each other’s signals. The primary groups of indicators are trend indicators, momentum indicators, volatility indicators and volume indicators.

Type 1: Trend indicators.

Average Directional Indicators

” Trend is your pal” is a widely known stating. Typical Directional Index is one of them. It has 3 components, Plus Directional Movement Index (DI+), Minus Directional Movement Index (DI-) and ADX line. If DI+ is higher than DI-, the currency set remains in an uptrend. If DI- is higher than DI+, it remains in a drop. The ADX line is a smooth moving average of outright values of DI+ and DI- and its value remains in a range between 0 and 100.

If the ADX value is in between 0 and 25, there is no trend or it is very weak. Between 25 and 50, the pattern is strong, and the pattern is extremely strong if ADX worths are between 50 and 75. Very strong patterns have worths between 75 and 100. The default period for ADX is 14 bars or candle lights, but you can try out different durations.

Moving Averages

Moving averages can also work to identify a trend and the easiest way is to plot one basic moving average on a chart and inspect if the rate is above or below the moving average. If it’s above, that would be a signal that the currency pair is in an uptrend. You can likewise utilize two moving averages, for instance, 100-day and 200-day MA. Because case, you would get a buy signal when the 100-day MA relocations above the 200-day MA.

Parabolic

Parabolic SAR is quite basic to utilize. Technical analysts draw it on a chart as a series of dots, above or below a candle or a bar. When it is drawn above the rate, that is a sign of a bearishness. The indication is good for finding turnarounds. If the dots shift from above to below, you can interpret that as a start of an uptrend. A possible strategy could be to wait on a shift and purchase when four dots in a row appear listed below candles.

Type 2: Momentum Indicators

This group of indicators determines the speed of a cost modification and they are likewise called Rate of modification indicators.

Relative Strength Index

The Relative Strength Index or RSI can help you to determine if the currency pair is overbought or oversold. The default period for calculation is 14 candles or bars and its value oscillates between 0 and 100. The RSI worth of 70 or greater is thought about as overbought area, while a worth listed below 30 typically means that the currency pair is oversold.

Moving Average Convergence Divergence

Moving Average Convergence Divergence, or MACD, is another momentum indication. It has the MACD line, signal line and MACD histogram. The MACD line is normally computed by deducting the 26-day rapid moving average (EMA) from the 12-day EMA. The signal line is a nine-day EMA of the MACD line and the MACD histogram is the difference between the MACD line and the signal line. In a trading method, traders can search for crossovers between the MACD line and the signal line, however they can also search for a divergence in between the price and the MACD. If the rate records 2 rising highs and MACD records two falling highs, that would be a bearish signal.

For momentum, you can likewise utilize the stochastic oscillator and Ichimoku Kinko Hyo. The stochastic indicator is used to recognize overbought and oversold conditions, while Ichimoku Kinko Hyo represents a mix of support and resistance levels, crossovers, oscillators and trend indicators.

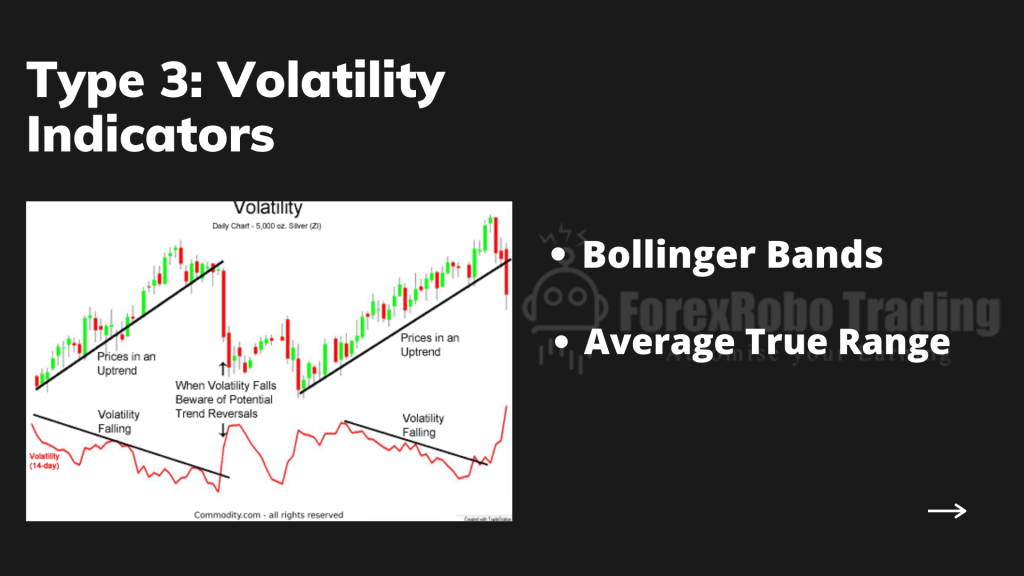

Type 3: Volatility Indicators

Bollinger Bands

Bollinger Bands can assist you determine the volatility of a currency pair. To make use of a chart, you initially require to calculate a standard deviation of a cost. You add two standard deviations to a moving average and you also subtract two basic discrepancies from the moving average.

Now you try to find the moments when the price gets above the upper band or listed below the lower band. Some traders would see the breakout above the upper band as a signal of an extension of the relocation, while others would see it as the reversal indication.

Average True Range

Average True Range is calculated as EMA of the true range, which uses the greatest worth of the distinction between the high and low rate of the day, high and close or close and low. It is used to determine volatility and it can be helpful as a danger management tool.

Type 4: Volume Indicators

Chaikin Money Flow

Indicators can likewise consist of volume in the estimation. Chaikin Money Flow (CMF) is one example. Its possible series of movement is between 1 and -1, however it typically moves between 0.5 and -0.5. Worths higher than absolutely no show a buying pressure, while values below zero indicate a selling pressure.

Accumulation Distribution Line

Accumulation Distribution Line likewise uses volume. It is used to confirm the trend. When it relocates the same instructions as the cost it indicates the confirmation of the pattern.